Understanding a Balance Sheet With Examples and Video Bench Accounting

Owners’ equity, also known as shareholders’ equity, typically refers to anything that belongs to the owners of a business after any liabilities are accounted for. When you’re starting a company, there are many important financial documents to know. It might seem overwhelming at first, but getting a handle on everything early will set you up for success in the future. Today, we’ll go over what a balance sheet is and how to master it to keep accurate financial records.

How often are balance sheets required?

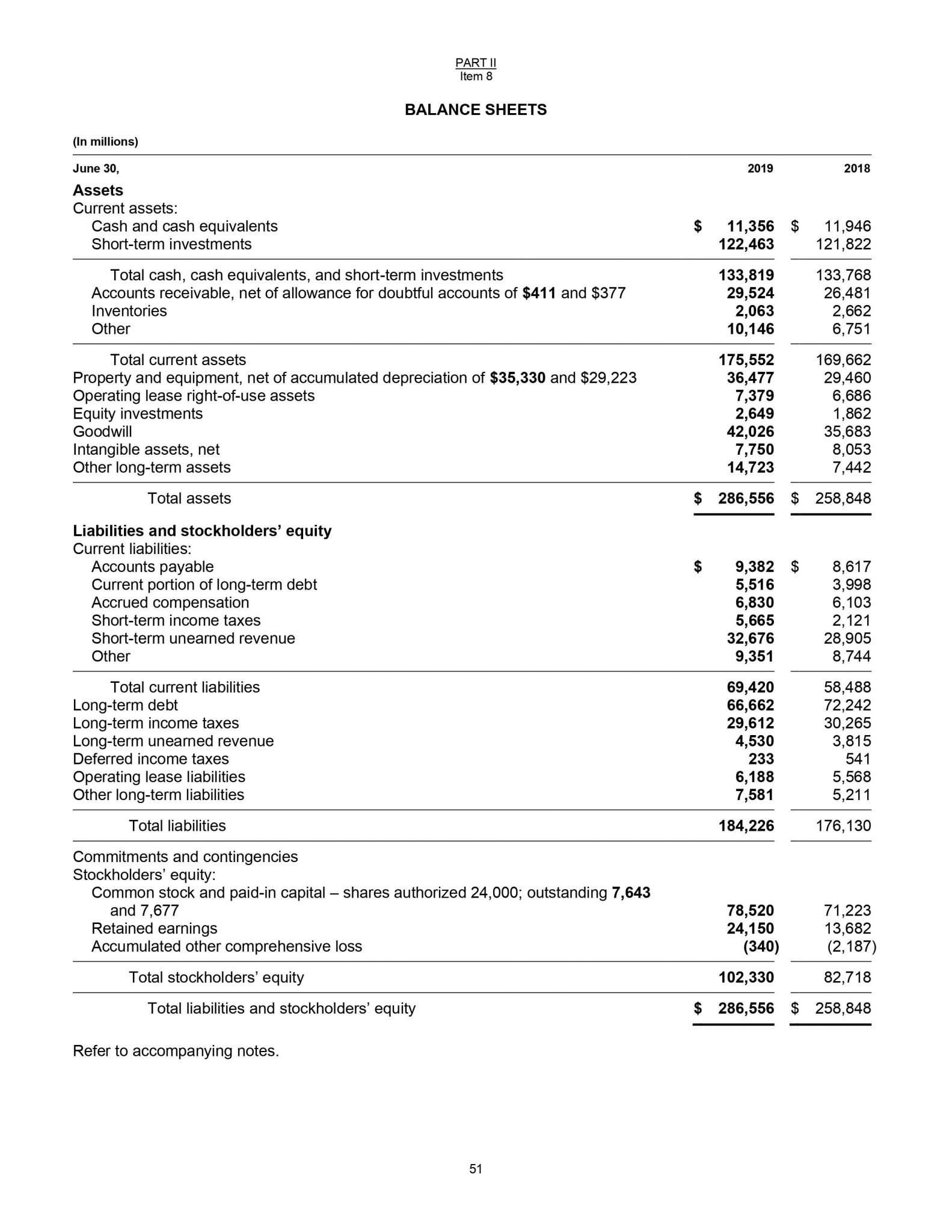

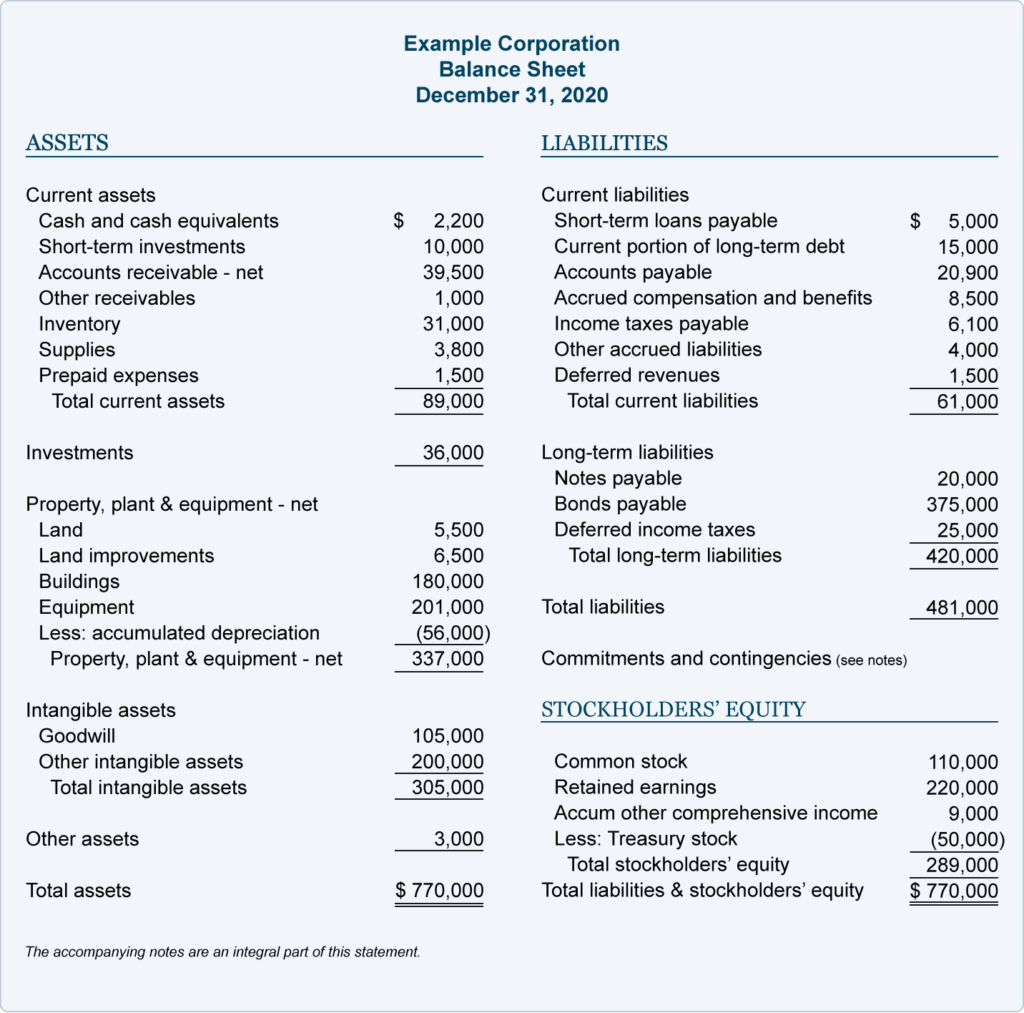

Shareholders’ equity is the initial amount of money invested in a business. The balance sheet is one in a set of five financial statements distributed by a U.S. corporation. To get a complete understanding of the corporation’s financial position, one must study all five of the financial statements including the notes to the financial statements. The balance sheet is basically a report version of the accounting equation also called the balance sheet equation where assets always equation liabilities plus shareholder’s equity. In this example, the imagined company had its total liabilities increase over the time period between the two balance sheets and consequently the total assets decreased. Balance sheets are important because they give a picture of your company’s financial standing.

How to automate balance sheet reporting with QuickBooks

- Investors and potential stakeholders often use the balance sheet to assess a company’s financial health before making investment decisions.

- This document gives detailed information about the assets and liabilities for a given time.

- This financial statement lists everything a company owns and all of its debt.

In essence, assets signify the company’s resources and potential for generating future economic benefits. QuickBooks Online users have year-round access to QuickBooks Live Assisted Bookkeepers who can give personalized answers to bookkeeping questions and help manage their finances. Schedule a free consultation to get pricing components of an internal control system details and walk through the service. If both sides of the balance sheet equation aren’t equal, a business may have financial issues. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Limitations of Balance Sheets

Shareholder’s equity is the net worth of the company and reflects the amount of money left over if all liabilities are paid, and all assets are sold. For instance, if a company takes out a ten-year, $8,000 loan from a bank, the assets of the company will increase by $8,000. Its liabilities will also increase by $8,000, balancing the two sides of the accounting equation.

EBITDA is likely to rise under IFRS 16 for companies that have large-scale lease arrangements, as the majority of the former rental expenses will be reflected in depreciation and interest. The survey showed that some companies have adjusted EBITDA to include depreciation of right-of-use assets and interest expenses on lease liabilities to keep the basis of measurement consistent across the years. Standard costing has been a foundational tool in cost accounting for decades, helping businesses set predetermined costs for products and measure variances against actual costs.

Debt vs. Equity

This structure helps investors and creditors see what assets the company is investing in, being sold, and remain unchanged. Ratios like the current ratio are used to identify how leveraged a company is based on its current resources and current obligations. When setting up a balance sheet, you should order assets from current assets to long-term assets. They’re important to include, but they can’t immediately be converted into liquid capital.

They are crucial for assessing a company’s short-term liquidity, which refers to its ability to meet its short-term financial obligations and pay off its current liabilities. The balance sheet includes information about a company’s assets and liabilities, and the shareholders’ equity that results. These things might include short-term assets, such as cash and accounts receivable, inventories, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may include short-term obligations such as accounts payable to vendors, or long-term liabilities such as bank loans or corporate bonds issued by the company.

Pay attention to the balance sheet’s footnotes in order to determine which systems are being used in their accounting and to look out for red flags. Regardless of the size of a company or industry in which it operates, there are many benefits of reading, analyzing, and understanding its balance sheet. Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt.

Common ones include mortgages, student loans, car payments and credit card bills. As you can see from the balance sheet above, Walmart had a large cash position of $14.8 billion in 2024, and inventories valued at over $54.9 billion. This reflects the fact that Walmart is a big-box retailer with its many stores and online fulfillment centers stocked with thousands of items ready for sale. This is matched on the liabilities side by $56.8 billion in accounts payable, likely money owed to the vendors and suppliers of many of those goods. Long-term liabilities are debts and other non-debt financial obligations, which are due after a period of at least one year from the date of the balance sheet. For instance, a company may issue bonds that mature in several years’ time.

Share capital is the value of what investors have invested in the company. Shareholders’ equity belongs to the shareholders, whether public or private owners. Current liabilities refer to the liabilities of the company that are due or must be paid within one year. It can be sold at a later date to raise cash or reserved to repel a hostile takeover.

All participants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program. If a balance sheet doesn’t balance, it’s likely the document was prepared incorrectly. External auditors, on the other hand, might use a balance sheet to ensure a company is complying with any reporting laws it’s subject to.